In the News

Reputation impact heightened in face of pandemic

22 February 2021

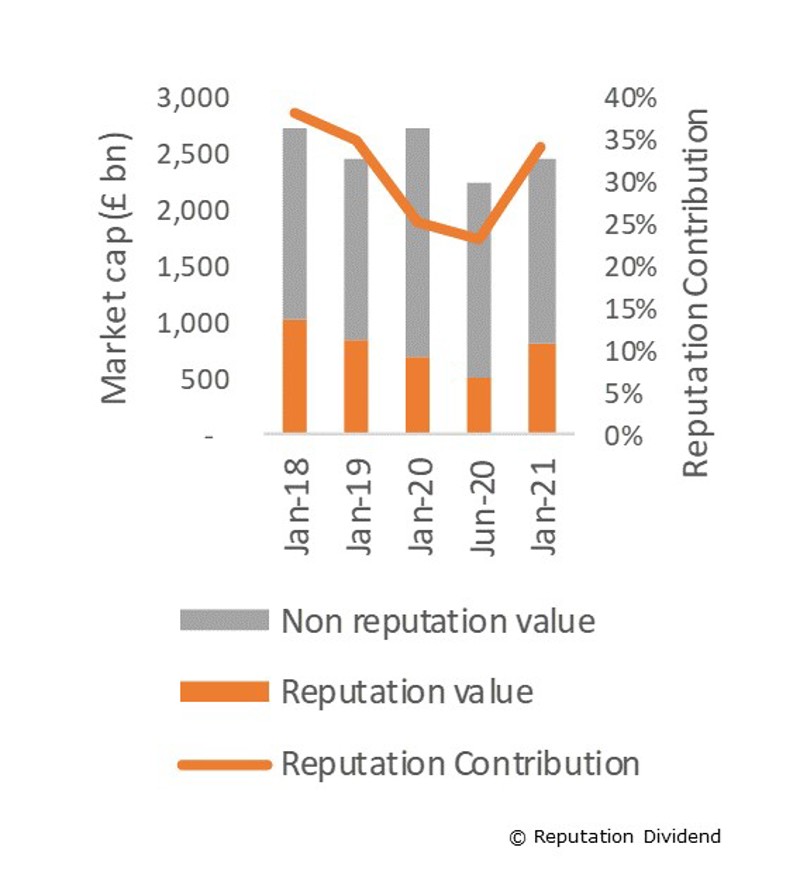

Some positive news from the pandemic: corporate reputation in the UK now accounts for one in every three pounds on the stock market.

UK company reputations constitute more than a third of the combined market capitalisation of the FTSE 350, worth £823 billion of shareholder value at the start of this year, according to the latest results from analysts at Reputation Dividend.

Based on the detailed study of the stock market every year since 2009, the analysts found that corporate reputations have played a major part in protecting value through the crash, minimising the scale of the decline and fuelling the recovery.

The financial value of corporate reputation in the FTSE 350

Unilever leads, with Astra Zeneca in 2nd place

Reputation contributions for all listed companies were mainly positive this year, with as much as 56.6% for Unilever in top place, indicating value creation over the pandemic.

However, in close to 20 cases they were sufficiently poor as to be a drain on companies’ market caps, and costing shareholders accordingly.

The most impactful corporate reputations in the UK

According to Reputation Dividend’s Simon Cole: “Once the initial shock of the pandemic downturn had subsided, investor attention turned to corporate qualities that not only suggested companies are well placed to ride the storm but also, and critically, best positioned to capitalise on the up-turn as and when it comes. The reputational drivers for this recovery include high quality of goods and services, a focus on innovation and securing the right kind of talent.”

The study added that while some industries have been hit particularly hard – Hospitality, Travel, Oil –others have benefitted from a combination of rising demand and expectation. Added Sandra Macleod, Director at Reputation Dividend: “reputations will need to carry on playing a major part in order to see companies through to the eventual recovery. Companies need to mobilise them now in order not to miss the boat.”

About Reputation Dividend: Reputation Dividend was founded by a team of reputation and brand economists and analysts in 2009. It is the only recognised consultancy focused on the financial value of corporate reputation measured in hard monetary terms. Its mission is to help companies deliver more effective reputation management through measuring, monitoring and evidencing the financial impact of companies’ reputations. Reputation Dividend is a trusted adviser to leading companies in the United States, the United Kingdom, mainland Europe and the Far East and publisher of the annual UK and US Reputation Dividend reports now in their 13th year.